Youth Loan Scheme 2025 – Get Business & Agriculture Loans Up to 75 Lakh

Youth Loan Scheme 2025

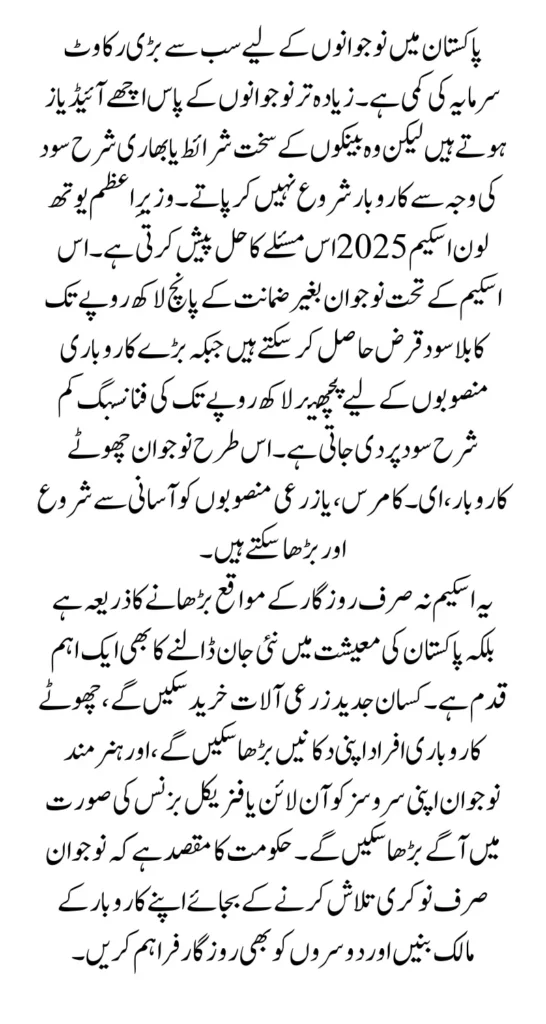

Youth Loan Scheme 2025 Government of Pakistan has relaunched the Prime Minister Youth Loan Scheme 2025, with the aim of empowering young entrepreneurs, students, and farmers. Under this program, loans ranging from Rs. 5 lakh to Rs. 75 lakh are being offered at zero to low markup rates, making it easier for the youth to start or expand their businesses. This initiative not only supports small-scale enterprises but also promotes agricultural growth, creating new job opportunities across the country

Unlike traditional bank loans that require heavy collateral and carry high interest rates, the PM Youth Loan Scheme offers loans ranging from Rs. 500,000 to Rs. 7,500,000 at zero to very low markup. This gives young entrepreneurs and farmers a fair chance to access credit without being trapped in debt. The program is structured to support multiple sectors, including small businesses, startups, agriculture, and even IT-related projects, ensuring that Pakistan’s youth can contribute to national growth in diverse fields.

You Can Also Read: Punjab Green Credit 2025: How Citizens

Key Features of PM Youth Loan Scheme 2025

The scheme has been designed with special consideration for the financial challenges faced by youth and small business owners. Its unique features make it more attractive compared to traditional bank loans.

- Loan range: Rs. 500,000 to Rs. 7,500,000

- Interest-free loans up to Rs. 500,000

- Low markup rate starting from 5% for higher amounts

- Available for both business and agriculture sectors

- Repayment period up to 8 years with a grace period

- Easy online application through official portal

These features make the scheme highly inclusive and accessible for both rural and urban applicants.

You Can Also Read: BISP 8171 September 2025 Re-survey Required

Eligibility Criteria for Applicants

To ensure transparency and fairness, the government has set clear eligibility rules. Any Pakistani citizen meeting these requirements can apply for the loan.

- Must be a Pakistani national with a valid CNIC

- Age limit: 21 to 45 years (18 years for IT-related businesses)

- Applicant should have a business idea, startup, or running business

- Farmers with valid land ownership can apply for agriculture loans

- Women, differently-abled persons, and minorities are encouraged to apply

This broad eligibility ensures that a maximum number of youth can benefit from the scheme.

You Can Also Read: NADRA Offices in Sindh Agreement 13 New NADRA

Loan Categories and Markup Rates

The PM Youth Loan Scheme 2025 is divided into three tiers, depending on the amount of loan required. The markup rate and repayment plan vary accordingly.

| Loan Tier | Loan Amount (PKR) | Markup Rate | Repayment Tenure |

|---|---|---|---|

| Tier 1 | Up to 500,000 | 0% (Interest-Free) | 3 years |

| Tier 2 | 500,001 – 1,500,000 | 5% | 5 years |

| Tier 3 | 1,500,001 – 7,500,000 | 7% | 8 years |

This table clearly shows that the government has kept smaller loans completely interest-free, while larger loans still remain very affordable compared to market rates.

Application Process – How to Apply

Applying for the PM Youth Loan Scheme 2025 is simple and completely digital. Applicants only need to follow a few steps through the online portal.

- Visit the official PM Youth Loan Portal.

- Fill in your personal, educational, and business details.

- Upload the required documents (CNIC, business plan, income proof).

- Select your loan tier and bank of choice.

- Submit the application and wait for verification.

Once the application is approved, the loan amount is directly disbursed into the applicant’s bank account.

You Can Also Read: How to Apply for the Free Solar Panel Scheme

Benefits for Youth, Farmers & Entrepreneurs

The scheme is expected to benefit thousands of people across Pakistan, particularly in rural and semi-urban areas where access to finance is limited.

- Encourages youth entrepreneurship and innovation

- Provides interest-free loans for small startups

- Special support for farmers and agri-businesses

- Promotes job creation and economic growth

- Easy access to financing without complex bank procedures

This initiative is not only a financial support program but also a step toward building a stronger economy led by the youth.

Final Words

The PM Youth Loan Scheme 2025 is a golden opportunity for Pakistani youth to turn their business ideas into reality. With interest-free loans, low markup financing, and flexible repayment terms, it removes the biggest hurdle faced by new entrepreneurs—lack of capital. Whether you are a small business owner, a young farmer, or a student with a startup idea, this scheme gives you the financial freedom to grow and contribute to the nation’s economy.

You Can Also Read: Punjab Housing Scheme How the Government