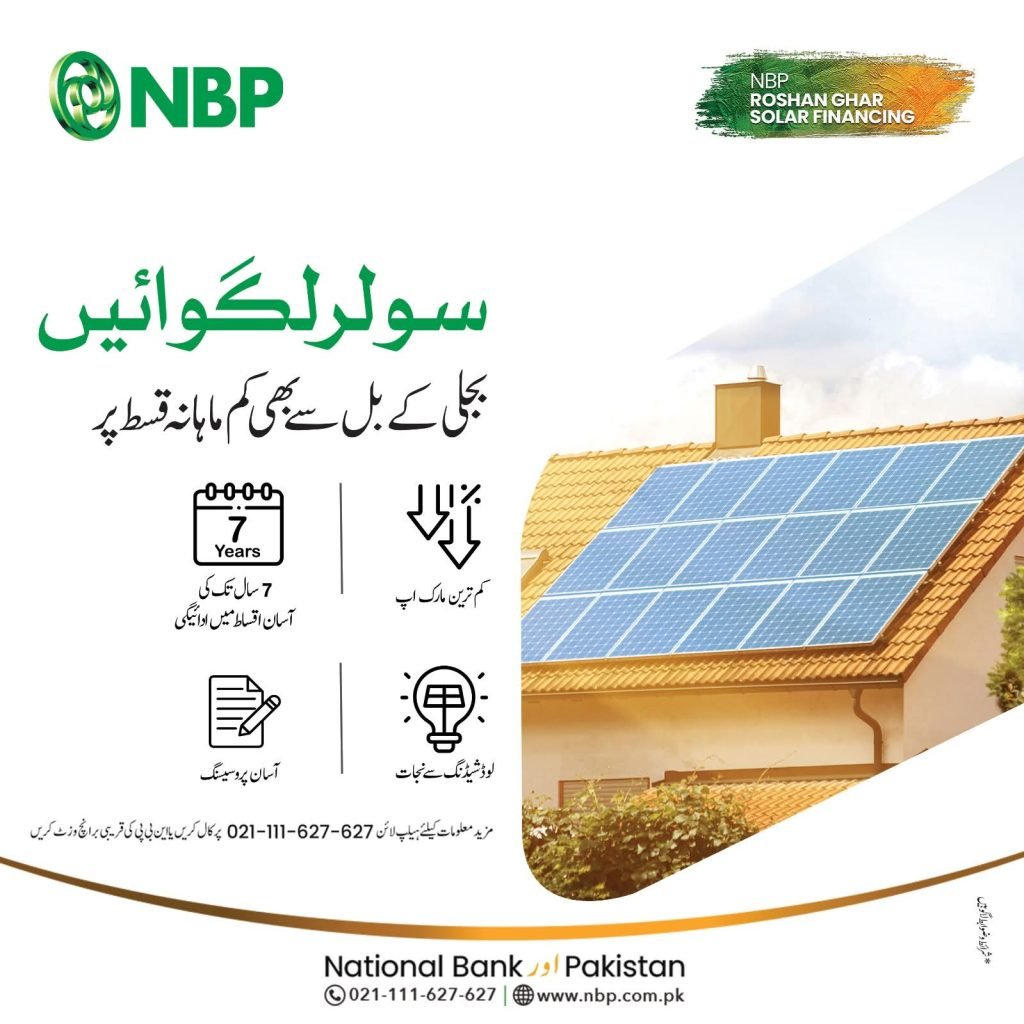

NBP Roshan Ghar Solar Financing – Affordable Solar Energy with Easy Installments

Learn about NBP Roshan Ghar Solar Financing 2025. Get solar panels on low markup, 7-year easy installments, and say goodbye to electricity bills. Apply today!

☀️ What is NBP Roshan Ghar Solar Financing?

NBP Roshan Ghar Solar Financing is a new and smart step by National Bank of Pakistan (NBP). It helps people install solar energy systems at home. You can now enjoy electricity without high bills and without loadshedding.

NBP offers this service with very low markup and easy installments for up to 7 years. This means you can save money while going green.

📈 Why Choose NBP Roshan Ghar Scheme?

Here are the top reasons:

- ✅ Low Markup Rate – Save big on interest charges

- ✅ Easy Monthly Installments – Pay less than your current electricity bill

- ✅ Up to 7 Years Tenure – Long repayment time for ease

- ✅ No More Loadshedding – Get energy independence

- ✅ Quick Processing – Simple and fast application

👩💼 Who Can Apply?

- Pakistani citizens with CNIC

- Homeowners (owned or rented with proof)

- Having regular income (salaried or business)

📋 What Documents Are Required?

- CNIC copy (applicant and co-applicant if any)

- Latest salary slip or business income proof

- Electricity bill (last 3 months)

- Bank statement (last 6 months)

- Property ownership/rent agreement

🏢 System Size & Cost Coverage

NBP offers financing for systems from 1kW to 10kW. It covers:

- Solar panels

- Inverters

- Batteries (if applicable)

- Installation charges

🌐 How to Apply?

Step-by-step process:

- Visit your nearest NBP branch

- Request for Roshan Ghar Solar Financing Form

- Fill out the form and attach required documents

- Submit your application

- Wait for approval and system installation

To download application from from officail website of National Bank of Pakistan visit this link https://www.nbp.com.pk/RoshanGharSolarFinance/Document/Application_Form.pdf

For help, you can also call NBP Helpline: 021-111-627-627

: NBP روشن گھر سولر فنانسنگ 2025

نیشنل بینک آف پاکستان (NBP) نے “روشن گھر سولر فنانسنگ اسکیم” کا آغاز کیا ہے تاکہ پاکستانی گھرانے سستی اور ماحول دوست بجلی حاصل کر سکیں۔ اس اسکیم کے تحت آپ آسان اقساط میں سولر پینل لگا سکتے ہیں، جو آپ کے بجلی کے مہنگے بلوں سے بھی سستا پڑے گا۔

یہ سہولت صرف کم مارک اپ کے ساتھ ہی دستیاب نہیں بلکہ 7 سال تک کی آسان قسطوں میں واپسی بھی ممکن ہے۔ مزید یہ کہ لوڈشیڈنگ سے نجات اور بجلی کی خود کفالت بھی اس منصوبے کا حصہ ہے۔

📝 اہلیت کے معیار:

پاکستانی شہریت رکھنے والے افراد

ذاتی یا کرایہ کے گھر میں رہائش (ثبوت کے ساتھ)

مستقل آمدنی رکھنے والے (ملازم یا کاروباری)

📑 درکار دستاویزات:

CNIC کی کاپی

آمدنی کا ثبوت (تنخواہ کی سلپ یا کاروباری دستاویز)

پچھلے 3 ماہ کا بجلی کا بل

6 ماہ کا بینک اسٹیٹمنٹ

مکان کی ملکیت یا کرایہ داری کا معاہدہ

📝 درخواست دینے کا طریقہ:

قریبی NBP برانچ جائیں

روشن گھر سولر فنانسنگ فارم حاصل کریں

مکمل فارم اور مطلوبہ دستاویزات جمع کروائیں

منظوری کے بعد انسٹالیشن کا عمل شروع ہوگا

مزید معلومات کے لیے 021-111-627-627 پر کال کریں

CM Punjab has stated a great program for youth and businessmen : CM Parwaz Card Program check details here https://papayawhip-chinchilla-306433.hostingersite.com/cm-punjab-parwaz-card-program-2025-online-apply-guide/

⚠️ Important Notes

- Financing is subject to credit approval

- System installation will be done by approved vendors

- Maintenance and warranties are provided by installers

FAQs

- What is NBP Roshan Ghar?

NBP Roshan Ghar is a solar financing product by National Bank of Pakistan. - Who is eligible?

All resident Pakistanis with valid CNICs, clean e-CIB/DataCheck, and meeting income/collateral requirements. Govt employees with salary accounts in NBP are preferred. - Can overseas Pakistanis apply?

No, only resident Pakistanis with local income sources are eligible. - How are repayments made?

Via auto debit from the NBP account. For govt employees, deduction is from their salary account. - Can I apply with a co-applicant?

Yes, especially to club incomes or due to property ownership. - How is disbursement made?

In two tranches. - Which cities are covered?

All cities/districts with NBP branches. - Can I apply for a flat/apartment?

Yes, with NOC from building management and space for panels. - Can I apply if my house is jointly owned by parents?

Yes, spouse, parents, or adult male children can be co-applicants. - Who can be a co-applicant?

Spouse, parents, or adult male children (not siblings).

🔹 Product Features

- Financing Range

- Regular: Rs. 400,000 – Rs. 5,000,000

- Govt Employees: Up to Rs. 3,000,000

- Collateral Requirements

- Equitable mortgage

- Lien on NBP deposit/TDRs

- Gold/DSC pledge

- For govt employees: No mortgage, only guarantee & employer undertaking

- Tenure

Up to 7 years (84 months)

🔹 Markup Details

- Markup Type

Floating Rate - Markup Rate

1-Year KIBOR + 2% - Grace Period?

No grace period

🔹 Eligibility Criteria

- Finance-to-Equity Ratio

- Max 80% financing

- 20% customer equity

- Debt Burden Ratio

Max 50% of disposable income - Minimum Income Required

- Govt employee: Rs. 25,000

- Private employee: Rs. 35,000

- Business/self-employed: Rs. 70,000

- Can spouse apply with low income?

Yes, income can be clubbed if it meets minimum requirement. - Age Requirements

- Salaried: 22–60 years

- Self-employed: 22–65 years

- Work/Business Experience

- Salaried: 1 year in current job, 3 years total

- Govt: 1 year (permanent), 2 years (contract)

- Business: 3 years in same business

🔹 Fees & Repayment

- Processing Fee

2% of loan or max Rs. 20,000 - Can I pay early?

Yes, with no penalty. - Late Payment Charges?

Yes, based on NBP Schedule of Charges.

🔹 Insurance

- Insurance Payment

- 1st year upfront

- Post-dated cheques for following years

🔹 Vendors & Property Requirements

- Approved Vendors

AEDB registered or non-AEDB approved by bank - Property Document Verification?

Yes, through legal opinion - Property Eligibility

- Residential

- Must be mortgage-able

- Verified by NBP legal panel

- Commercial Property?

Not eligible

🔹 Income Documentation

- For Salaried (Non-Govt)

- Salary slips, certificate, bank statement

- CNICs, job ID, undertakings

- Contract/agreement verification

- For Govt Employees

- Salary slips, service certificate

- CNICs, job ID, employer undertaking

- Contract verification

- For Self-Employed/Business

- Tax returns (3 years)

- Bank statement (12 months)

- Business proof (registration, licenses, etc.)

✨ Final Thoughts

NBP Roshan Ghar Solar Financing is a game changer for Pakistani households. It gives you power, savings, and peace of mind.

No more high electricity bills. No more dark nights. Just clean, affordable energy.

Go solar today — with NBP!